Lindsey Rae Vaughn | Staff Reporter

Posted May 29, 2014; 8:30 p.m.

Some college students leave home for the first time once they move into their dorms and apartments to finish their degree.

Once they are finished and they are left with a mountain of student loan debt, what do most students end up doing? — Moving back in with mom and dad.

I am one of those students. I was gone for two years living two and a half hours away. I lived in a dorm and then in an apartment with no roommates. I was about as independent as a college kid could get.

With my student loans and credit card bill weighing heavier and heavier on my shoulders, I just couldn’t afford to move into another place on my own right after graduation. Now that I’m at home, I have several options that I can see any recent graduate taking.

This first is obviously renting an apartment or house.

Photo Courtesy of Lindsey Rae Vaughn

I have experienced this in St. Charles and it was a good experience, but I noticed several ways that apartment complexes try to take every penny you have to spare. There are fees for pets, limited leases, late rent, which way your apartment faces, how many people are living there, etc.

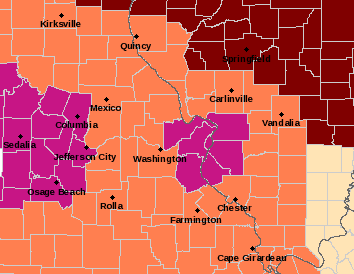

One problem I’m finding in my rural area is not having the opportunity to do research online. One day my mom and I spent an entire day in Anna, Illinois and the only place we could think of going to was real estate agencies. We left each one with the same piece of paper with about six names of people who rent in the area.

After calling all of them, only one had an opening, but the rent was only dollars away from my rent in the middle of St. Charles. Anna has a population of 4,392 compared to St. Charles population of 66,463. So I went back to the drawing board. With my low-income job that I talked about in my last article, I needed something cheaper.

Photo Courtesy of Lindsey Rae Vaughn

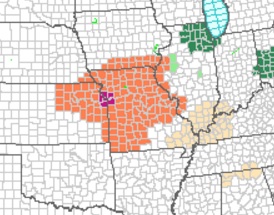

Another option that most fresh graduates don’t think about it purchasing a home and land. Currently, I am looking at a home that is listed at $47,500. According to the mortgage calculator, my monthly payment would be $309.81 with no down payment. It would take me 25 years to pay off my loan.

That sounds like a huge commitment for someone with no money and student loans. It’s a terrifying step. But this is how I look at it. When you are renting from someone, you are putting your money into someone else’s pocket. You never reap the benefits from paying that except for a temporary home that’s guaranteed that month. If you buy a home, you are putting money into yourself and an investment.

Of course, be smart about it. Buy something you think you could resale fairly easy and one you could still live in if one to two people was to take residence there as well. This is definitely an unconventional way for a new grad to start out, but I think it’s an option worth looking at.

The last option, which I’m sure most college students don’t think about, it buying a fixer-upper home at an auction. That is currently what I am considering doing. Find a home with some land that needs nothing but cosmetic work done to it so you can move into it soon and get a cheap price on it. All that it requires is a little elbow grease.

For example, say you have a property that has one home on it and five acres of land comes with it. You go to auction with the beginning bid at $12,000. The house has been abandoned for two years, but inside only requires new floors and paint. The land itself is worth more than $12,000. If you borrow $20,000 and pay only $15,000, you can use the extra $5,000 to repair the floors and paint and you have a house you can call your own in your early 20s.

How much will that cost a month?

According to a loan calculator, my payment would be $140.73 a month and I would pay off my loan in 15 years. But the value of the home, once I fix it up, can double or even triple.

To me, it would be worth it. First off, $140 a month that I’m investing in myself sounds a lot better than paying five times that amount for something temporary. Even the $309 sounds better than that. I already have student loan debt, but it was worth it because I was investing in my education. You can view purchasing a home the same way: investing in your living situation.

No poll selected